Government Plans Gradual Increase in Value Added Tax (VAT) Rate

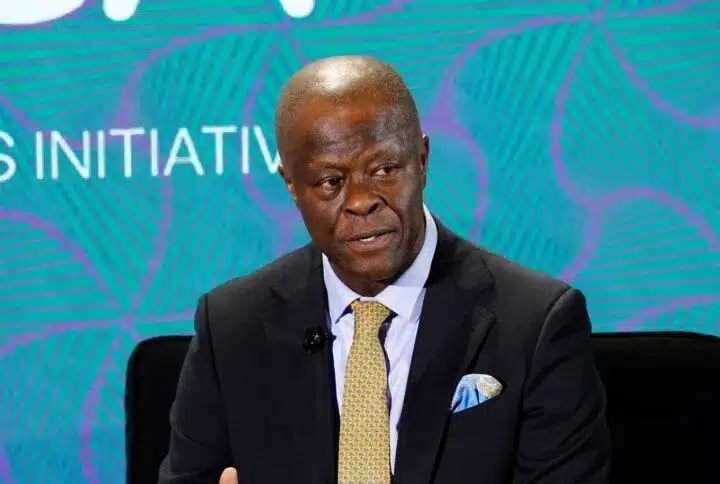

Nigeria’s Finance Minister and Coordinating Minister of the Economy, Wale Edun, has disclosed that the government is planning to raise the Value Added Tax (VAT) rate to 15%, but the increase will primarily target luxury goods.

Edun made this announcement during an investor forum at the IMF/World Bank Annual Meetings in Washington, D.C. He emphasized that the proposed VAT hike will be implemented gradually and will have a minimal impact on essential goods, such as those consumed by low-income and vulnerable individuals.

Government’s Commitment to Protect the Poor and Vulnerable

In his remarks, Edun highlighted the administration’s commitment to shield the poor and vulnerable from the effects of the VAT increase, citing President Bola Tinubu’s promise to “protect the poorest and most vulnerable while implementing difficult and wide-ranging but necessary reforms.” According to Edun, this means that essential goods will continue to be exempt from VAT or will have a zero rate applied.

The government plans to release a list of exempted goods later, providing clarity to the public and ensuring that the poor and average citizens are not negatively affected by the tax increase.

Promising Outlook for the Oil Sector

Edun also presented a positive outlook for Nigeria’s oil industry, attributing its future growth to enhanced security in oil-producing regions and significant investments from major players like Total and ExxonMobil.

He predicted that these developments will lead to increased oil production and a boost in foreign exchange earnings for the country.

Full Implementation of Subsidy Removal

Regarding the removal of fuel subsidies, Edun clarified that while the policy was announced earlier, its full implementation only took effect last month. He highlighted that the economic benefits, particularly the savings generated, will become more apparent in the coming months.

Nigeria’s Independence in Financial Decision-Making

When asked about the country’s relationship with the International Monetary Fund (IMF), Edun noted that Nigeria has chosen to issue domestic dollar bonds despite IMF concerns. He reiterated that the country maintains its autonomy in financial decision-making while still benefiting from the IMF’s support.